10 Behaviours to enjoy your retirement years

Eliza Hartley wrote on the 14th of May 2024: “People who genuinely enjoy their retirement years usually adopt these 10 behaviors.”

“Retirement can be either a joy or a burden. It all comes down to one simple thing – habits. Those who revel in their retirement years usually have certain behaviors that set them apart. These folks have learned the art of living their golden years to the fullest, by adopting some key habits. And let me tell you, these behaviors are worth emulating.

In this article, we’ll explore the 10 behaviors most common among people who truly love and enjoy their retirement years. Let’s dive in and see what these retirement gurus are doing differently!

1) Embrace lifelong learning

You’ve likely heard the phrase, “You can’t teach an old dog new tricks.” Well, I beg to differ. People who enjoy their retirement years often have adopted a mindset of lifelong learning. Being retired doesn’t mean you stop growing. It opens up a whole new universe of possibilities to explore and learn.

Whether learning a new language, picking up a musical instrument, or even studying astronomy, these knowledge seekers know that learning keeps their minds sharp and their lives interesting.

2) Maintain a healthy lifestyle

I’ve noticed that those who truly relish their retirement years often have one thing in common – they prioritise their health. A few years back when I first retired, I found myself falling into a pattern of inactivity and unhealthy eating habits. It was quite the wake-up call when I started feeling sluggish, unmotivated, and not at my best. So, I decided to make a change. I started taking walks every morning, just small ones at first, then gradually increasing my distance. I also made some changes to my diet, cutting out processed foods and upping my intake of fruits and vegetables. The result? I’ve never felt better! I have more energy, sleep better, and even my mood has improved.

I’ve found that by keeping myself physically active and nourishing my body with healthy foods, I’m able to enjoy my retirement years to the fullest. It’s not always easy, but the rewards are definitely worth the effort.

3) Stay socially connected

Maintaining social connections is a crucial part of a fulfilling retirement. And here’s something worth noting: according to the Harvard Study of Adult Development, our relationships and how happy we are in our relationships have a powerful influence on our health. Retirees who stay connected with friends and family tend to have a happier, healthier retirement.

Whether it’s weekly get-togethers with friends, daily phone calls with loved ones, or simply maintaining an active role in their communities, these individuals understand the value of staying socially engaged.

4) Cultivate a positive mindset

You’ve probably heard the saying “Attitude is everything,” and it couldn’t be more true when it comes to enjoying retirement. People who genuinely enjoy their retirement often have a positive outlook on life. They choose to focus on the good, find joy in the little things, and maintain an attitude of gratitude. They see retirement not as an end but as a new beginning, a chance to do things they’ve always wanted to do and live life on their own terms.

Cultivating a positive mindset isn’t always easy, especially when faced with challenges. But those who manage to do so often find that their retirements are much more enjoyable and fulfilling.

5) Pursue passions and hobbies

Retirement is the perfect time to pursue those passions and hobbies that you may not have had time for during your working years. Those who really love their retirement years often fill their time with activities they enjoy. It could be anything from gardening, painting, fishing, traveling, or even starting a small business around a hobby.

By investing time in things they love, these individuals ensure their retirement is filled with joy and satisfaction. It gives them a sense of purpose and keeps them engaged and excited about life.

6) Cherish family time

In retirement, it’s those everyday moments that really shine. Whether you’re hanging out with grandkids, enjoying dinner, or just cosying up with your partner, these moments are pure gold. Think about it – they’re where you find that deep connection, warmth, and happiness that nothing else quite matches.

But you know how it goes – life gets busy, and we sometimes forget to slow down and soak it all in. That’s where retirement comes in, giving us the chance to savor these special moments.

7) Practice mindfulness

In the hustle and bustle of life, we often forget to pause and be present in the moment. I myself have been guilty of this, letting life rush by in a whirlwind. When I retired, I found myself finally slowing down. This allowed me to discover the power of mindfulness – being fully engaged in the here and now.

Practicing mindfulness has truly transformed my retirement. From enjoying a quiet morning cup of coffee, to noticing the beauty of nature on my daily walks, to truly listening when my loved ones speak – every moment feels richer, more alive.

8) Embrace routine

Now, you might be thinking, “But isn’t retirement all about breaking free from the routine?” Well, yes and no. While retirement does free you from the 9-to-5 grind, having a certain level of structure in your daily life can actually enhance your enjoyment of these years. People who genuinely enjoy their retirement often have a daily or weekly routine they follow. This could include exercise, hobbies, social activities or even quiet time for reflection.

Having a routine provides a sense of purpose and organisation. It keeps you active and engaged, and it helps to ward off feelings of aimlessness that can sometimes creep in during retirement.

9) Keep financial stress in check

Financial worries can cast a shadow over your retirement years. Those who get to enjoy their retirement are often those who have planned well. Guess what? This doesn’t necessarily mean they’re wealthy. Instead, they understand their income and expenses, have a budget, and stick to it. They make sure their financial situation is such that it allows them to live comfortably without constant worry.

It might involve cutting back on some expenses or finding creative ways to supplement income, but the peace of mind it brings is priceless.

10) Remember to live in the moment

Retirement is a special time in life, a time to slow down and truly enjoy the fruits of your labour. Those who genuinely enjoy their retirement years understand the importance of living in the moment. They savor each day, each experience, each moment. They don’t spend their time worrying about what’s next or dwelling on the past. Instead, they are fully present, making the most of each day.

It’s a simple concept, but one that holds the key to truly enjoying your retirement years. So remember, live in the moment. It’s where the magic happens.

Retirement bliss: Living the dream, every day!

The beauty of retirement lies in the power of choices. The choices we make during this phase of life can significantly impact our overall happiness. Whether it’s choosing to learn, stay healthy, connect socially, maintain a positive mindset, pursue passions, cherish family time, practice mindfulness, follow a routine, manage finances wisely, or live in the moment – every choice counts.

As you navigate this unique journey called retirement, remember that the power lies within you. The choices you make can shape your retirement into the most fulfilling years of your life.”

To read the full article, please click here.

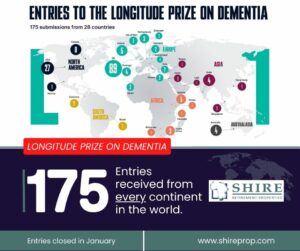

Founded in 2010 by Rob Jones in response to a clear need in the South African retirement industry for specialist independent consultants, Shire Retirement Properties is focused exclusively on the retirement industry. Shire provides a unique service to the industry through hands-on and dedicated advice and support, sometimes over several years as villages develop and become fully operational.

To contact us, click here.